Budget-friendly Family Pet Insurance Policy Program for every single Family Pet Parent

Navigating the landscape of budget friendly pet insurance strategies is critical for family pet parents intending to protect their fuzzy buddies while handling prices. With a range of alternatives readily available, from basic accident-only coverage to even more comprehensive strategies tailored to individual demands, understanding the nuances of each can make a significant distinction in monetary preparedness. Factors such as costs, deductibles, and supplier track record also play an important role in decision-making. As we check out these considerations, it becomes clear that notified options are necessary for making sure both pet wellness and financial security. What should be the next action in this essential journey?

Comprehending Animal Insurance Policy Basics

Understanding the principles of family pet insurance policy is essential for any type of pet owner seeking to protect their furry friends versus unexpected medical costs. Pet insurance coverage is made to ease the economic concern related to veterinary treatment, especially in emergencies or for chronic problems. It runs similarly to medical insurance for humans, with insurance holders paying a monthly premium in exchange for protection on different clinical solutions.

The majority of animal insurance plans cover an array of services, consisting of crashes, illnesses, and sometimes preventive treatment. It is essential for animal owners to be aware of policy exclusions, waiting durations, and insurance coverage limitations that might use.

Kinds of Pet Dog Insurance Policy Program

Pet dog insurance coverage plans can be classified right into several distinct kinds, each made to fulfill the varying demands of pet owners. One of the most typical types consist of accident-only strategies, which cover injuries resulting from accidents but exclude ailments. These plans are typically a lot more ideal and economical for family pet proprietors looking for standard security.

Extensive plans, on the other hand, offer more comprehensive protection by consisting of both crashes and ailments. This kind of plan is suitable for pet proprietors that desire substantial security for their pets, covering a large range of clinical issues, from minor disorders to persistent conditions.

An additional choice is a wellness or precautionary treatment strategy, which focuses on regular vet services such as inoculations, oral cleanings, and annual examinations. While these strategies generally do not cover emergency situations or diseases, they motivate positive health actions.

Finally, there are customizable plans, enabling animal owners to tailor their insurance coverage based on their pet dog's specific needs. This flexibility can aid take care of prices while ensuring sufficient coverage. Understanding these kinds of pet insurance coverage plans can empower pet proprietors to make informed choices that align with their economic and treatment concerns.

Variables Impacting Premium Costs

The price of pet insurance costs can vary substantially based on several essential factors. The pet dog's wellness background plays an essential role; pre-existing problems can lead to exclusions or elevated rates.

An additional significant variable is the degree of coverage selected. Comprehensive intends that consist of health care, preventive treatments, and greater compensation percents typically come with higher costs compared to basic plans. Additionally, the annual insurance deductible selected by the pet dog see owner can influence costs; lower deductibles generally result in greater regular monthly premiums.

Geographical area is additionally impactful, as vet care costs can differ widely throughout areas. Family pet parents in urban areas may encounter higher premiums than those in country settings. The insurance firm's rates design and the certain policy terms can also influence costs. When picking an insurance plan that fits their budget plan and their animal's requirements., recognizing these elements can assist animal owners make notified choices.

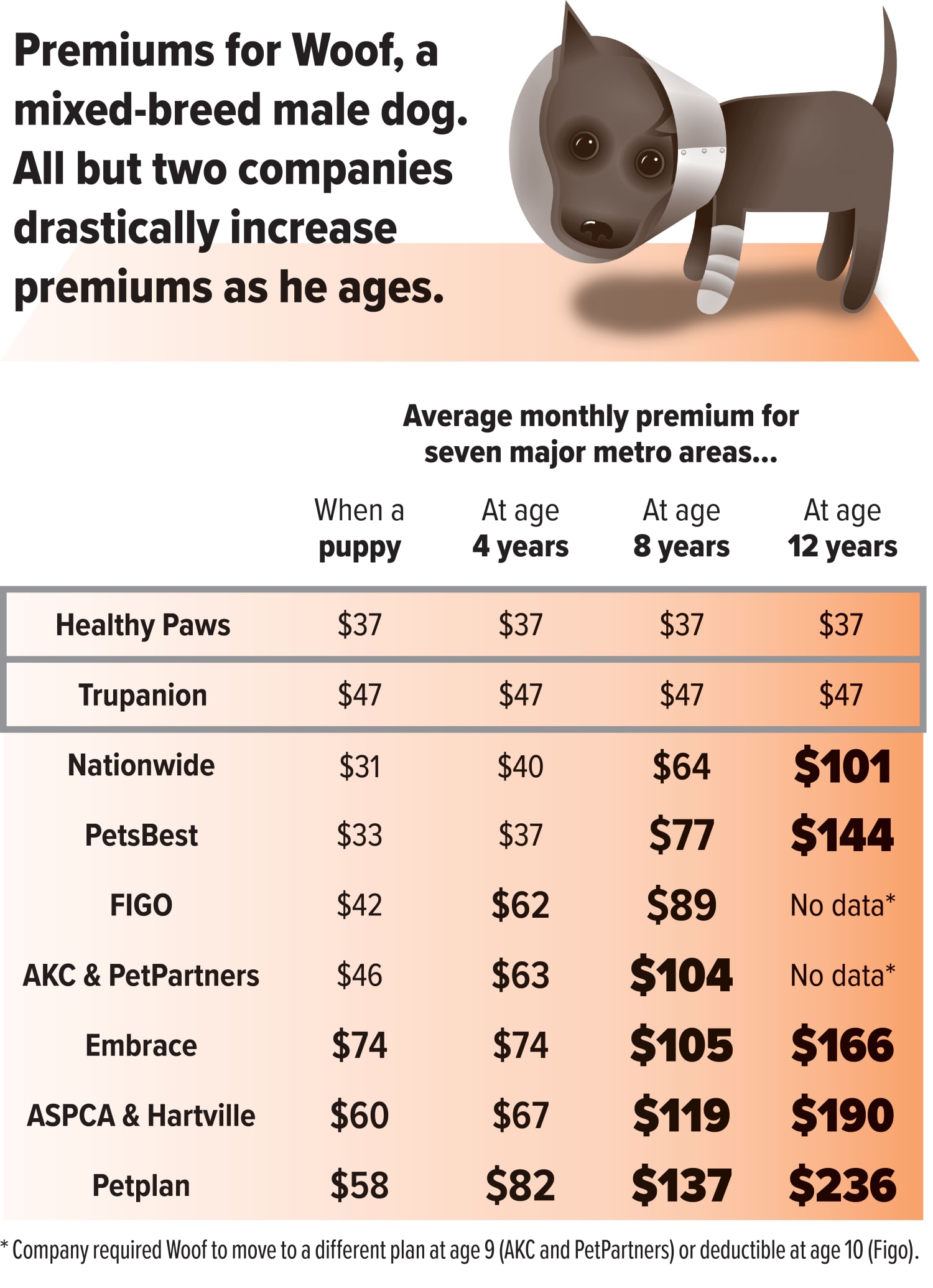

Comparing Top Pet Insurance Providers

Various animal insurance carriers provide a selection of strategies, making it essential for family pet proprietors to compare their options from this source thoroughly. Key players in the animal insurance policy market include Healthy and balanced Paws, Embrace, and Petplan, each offering one-of-a-kind functions that accommodate various requirements.

Its focus on client service and fast cases processing has gathered positive responses from pet dog proprietors. Alternatively, Embrace offers personalized plans, permitting pet owners to adjust deductibles and repayment degrees, which can lead to even more cost effective costs.

When comparing service providers, pet owners should take into consideration elements such as coverage limitations, exemptions, and the insurance claims procedure. By extensively examining these elements, pet parents can select a plan that ideal fits their financial and clinical requirements for their furry friends.

Tips for Picking the Right Plan

How can pet owners browse the myriad of alternatives available when choosing the ideal insurance policy prepare for their hairy companions? To begin, assess your pet's certain requirements based on wellness, breed, and age history. Older family pets or those with pre-existing go right here conditions may need even more comprehensive coverage, while younger pets may profit from basic plans.

Following, compare the protection options. Try to find strategies that consist of essential solutions like regular examinations, vaccinations, and emergency situation treatment. Bear in mind exemptions and waiting periods. Recognizing what is not covered is as vital as understanding what is.

:max_bytes(150000):strip_icc()/pet-insurance.asp_final-b03b3961816b4eab8ce11003e5cacdcc.png)

Checking out client testimonials and rankings can give insight into the copyright's integrity and customer solution. Lastly, think about the lifetime limitations on insurance claims, as some strategies cap payouts every year or per problem (Insurance).

Final Thought

Finally, affordable pet insurance policy plans are vital for managing unforeseen veterinary expenses while making certain optimal look after pet dogs. A comprehensive understanding of the numerous types of insurance coverage, costs determinants, and choices available from leading service providers substantially boosts the decision-making process for pet dog moms and dads. By carefully contrasting plans and thinking about private requirements, pet dog proprietors can safeguard efficient protection without stressing their finances, thereby advertising the health of their beloved companions.

Browsing the landscape of economical family pet insurance coverage strategies is important for pet dog parents aiming to guard their furry buddies while handling costs.Pet dog insurance strategies can be categorized right into several distinct kinds, each designed to satisfy the differing demands of animal owners. Recognizing these types of pet dog insurance strategies can encourage pet owners to make informed choices that line up with their financial and treatment top priorities.

Comprehending these factors can help pet dog owners make notified choices when selecting an insurance plan that fits their spending plan and their animal's demands.

In verdict, economical pet insurance plans are crucial for handling unforeseen vet expenditures while making certain ideal treatment for animals.